📈MA Cross Strategy Automation

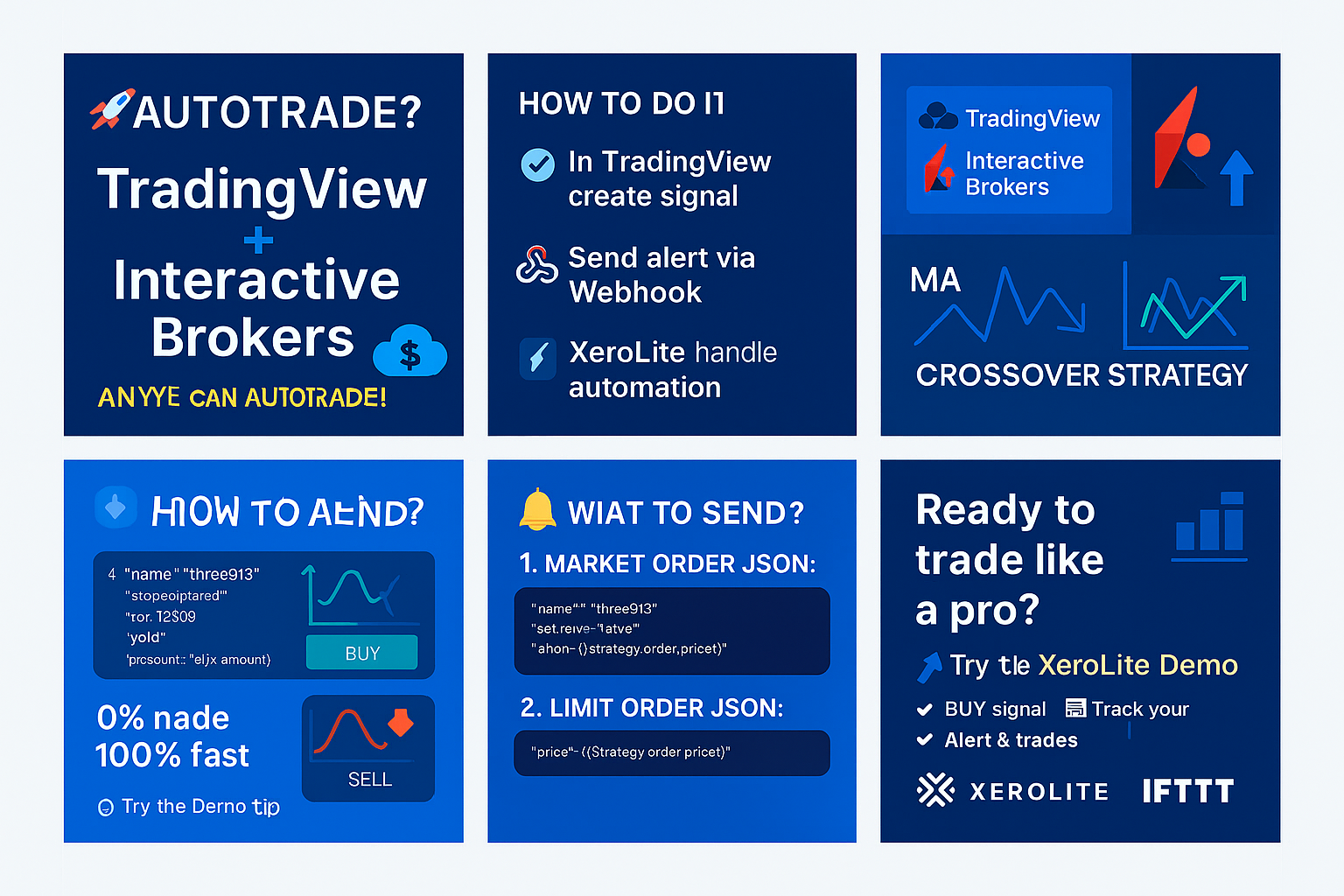

Ever wish your trades could place themselves — even while you’re away? Thanks to tools like TradingView, webhooks, and automation platforms like XeroLite, that’s now possible — even for beginners.

- Build a simple Moving Average Crossover strategy in TradingView

- Send real-time trade alerts via webhooks

- Automatically place trades on Interactive Brokers — with no coding required

✅ No coding

✅ Beginner-friendly

✅ Trade while you sleep

🧠 What Is the Moving Average Crossover Strategy?

A Moving Average (MA) is one of the simplest and most widely used tools in technical analysis. It smooths out price data over a period of time, helping traders identify the direction of the trend without the “noise” of daily price fluctuations.

There are two common types:

- Simple Moving Average (SMA): Takes the average of the closing prices over a set number of periods.

- Exponential Moving Average (EMA): Gives more weight to recent prices — reacts faster to price changes.

- Fast MA (e.g. 10-period): Follows recent price

- Slow MA (e.g. 30-period): Follows longer-term trend

🔄 Fast MA vs Slow MA

- Fast MA (e.g. 10-period)

- Reacts quickly to recent price changes

- Useful for spotting short-term trends or momentum

- Slow MA (e.g. 30-period)

- Moves more slowly

- Represents the broader, long-term trend

How Does a Moving Average Crossover Work?

A crossover happens when the fast MA and the slow MA intersect. This is often used as a buy or sell signal.

✅ Buy Signal

When the Fast MA crosses ABOVE the Slow MA, it suggests that momentum is shifting upward. This is called a bullish crossover — a signal to consider entering a long (buy) position.

❌ Sell Signal

When the Fast MA crosses BELOW the Slow MA, it indicates possible downward momentum. This is a bearish crossover — a signal to consider selling or shorting.

💡 Why It Works for New Traders

- Removes emotion: You follow the signal, not your feelings.

- Easy to understand: Just track two lines crossing.

- Catches trends: Helps you ride upward or downward moves early.

This method helps catch trends and avoid emotional decisions — perfect for those new to trading.

💻 Step 1: Create the Strategy in TradingView

Login to TradingView and open the “Pine Editor.” Paste this code:

//@version=6

strategy("MA Crossing Strategy", overlay=true)

fastMA = ta.sma(close, 10)

slowMA = ta.sma(close, 30)

plot(fastMA, color=color.green)

plot(slowMA, color=color.red)

if ta.crossover(fastMA, slowMA)

strategy.entry("long", strategy.long)

if ta.crossunder(fastMA, slowMA)

strategy.entry("short", strategy.short)

Click “Add to Chart” to view your signals. 🔍 Pro Tip: Adjust the periods based on your trading speed.

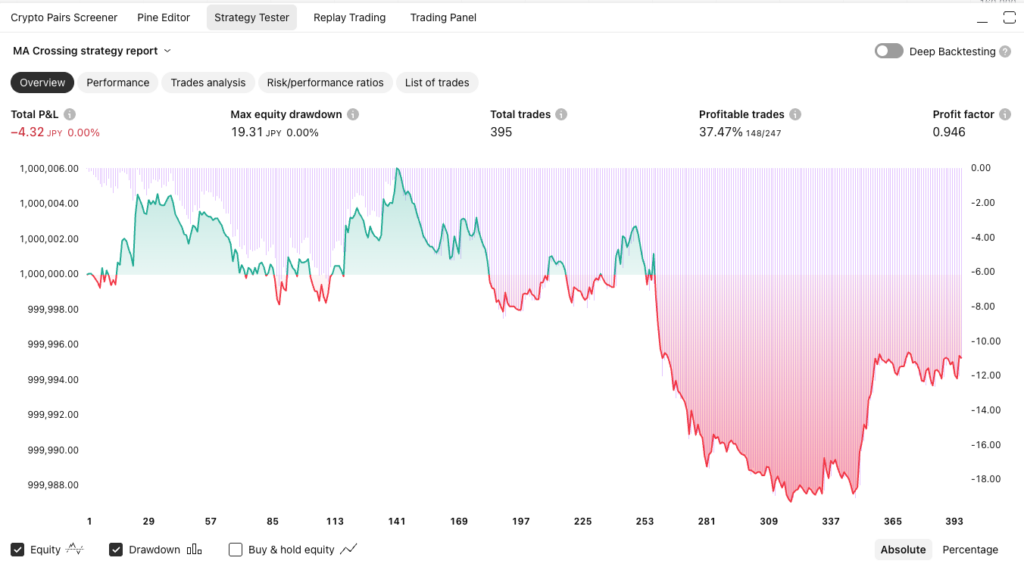

📊 Step 2: Backtest Your Strategy

Use the Strategy Tester in TradingView to analyze performance:

- Total profit/loss

- Drawdown

- Accuracy

This helps you refine before going live.

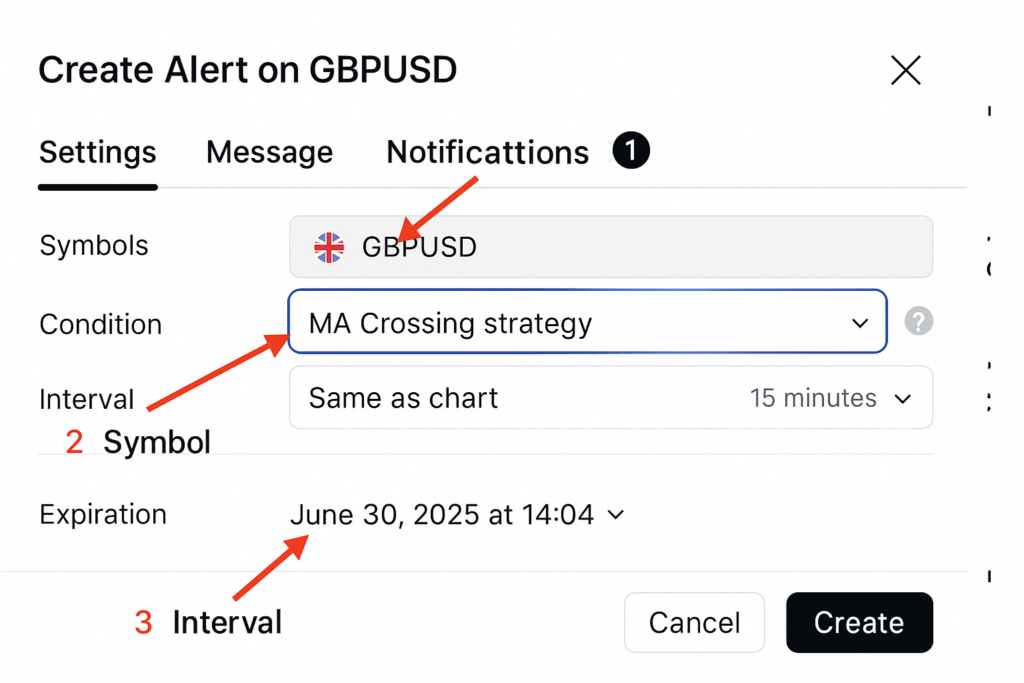

🔔 Step 3: Create a Webhook Alert in TradingView

- Click the “+” Alert icon at the top left of your alert log panel.

- In the Settings tab, set Condition to your strategy (e.g. “MA Crossing Strategy”).

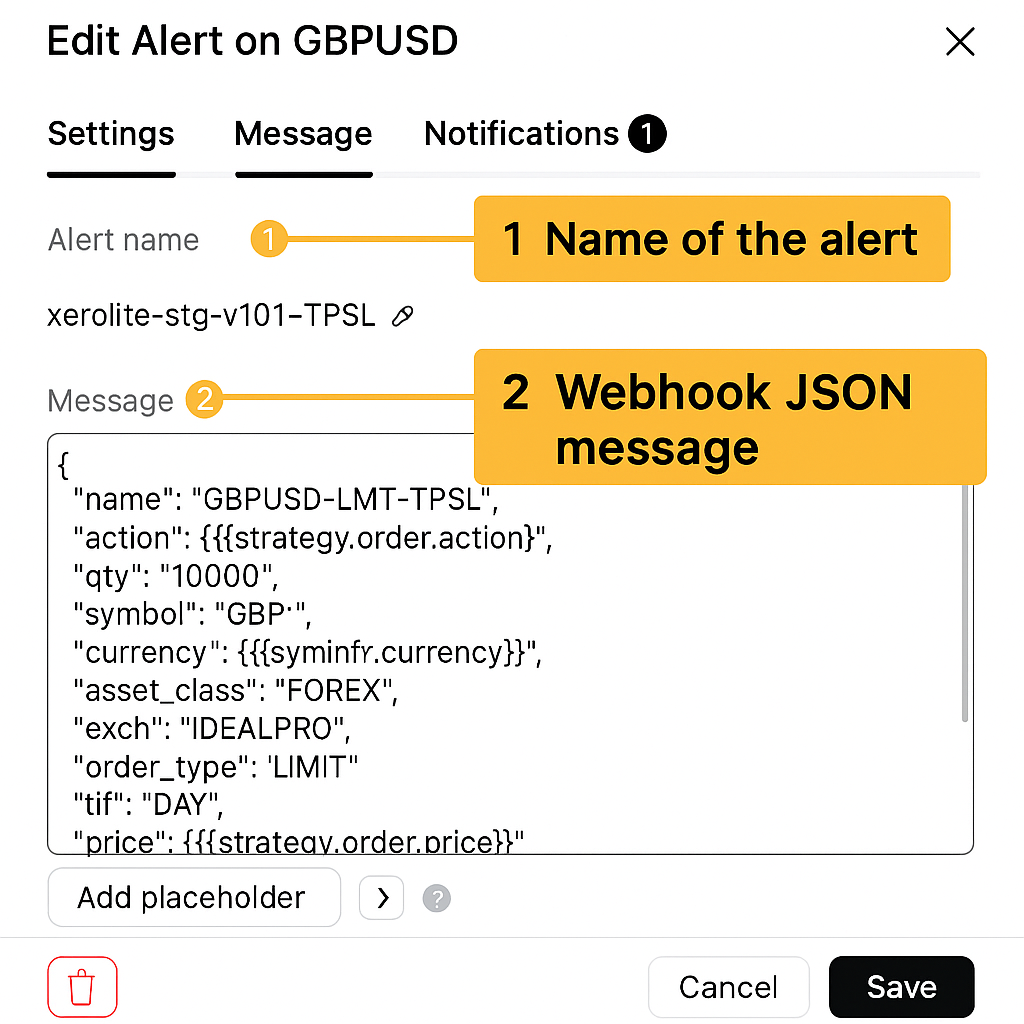

- In the Message tab, set a unique alert name and paste a valid alert JSON.

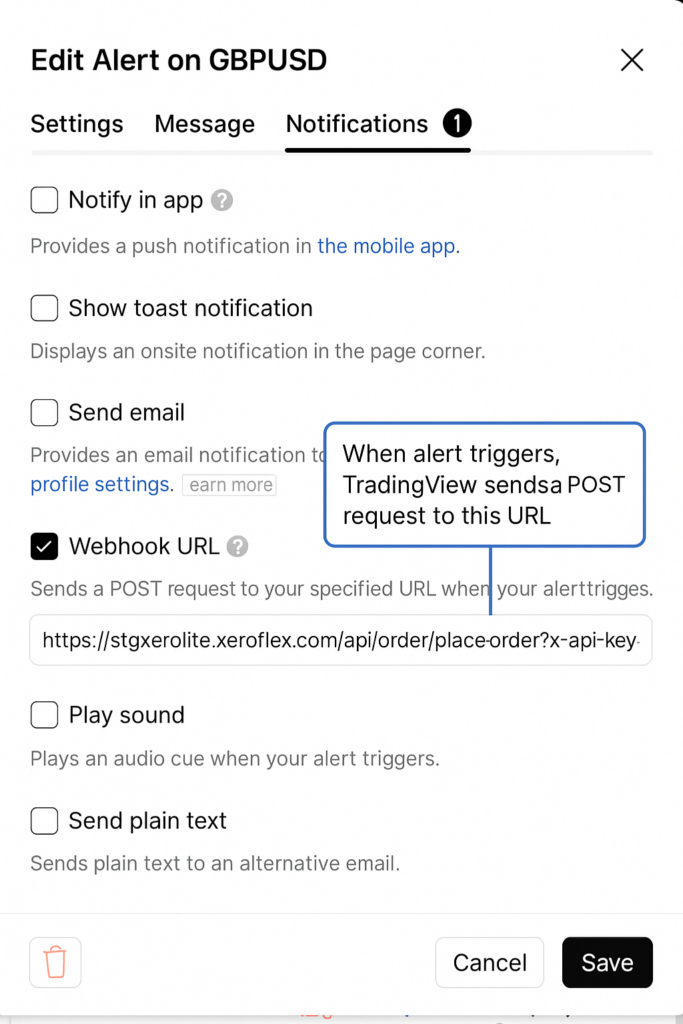

- In the Notifications tab, paste this webhook URL:

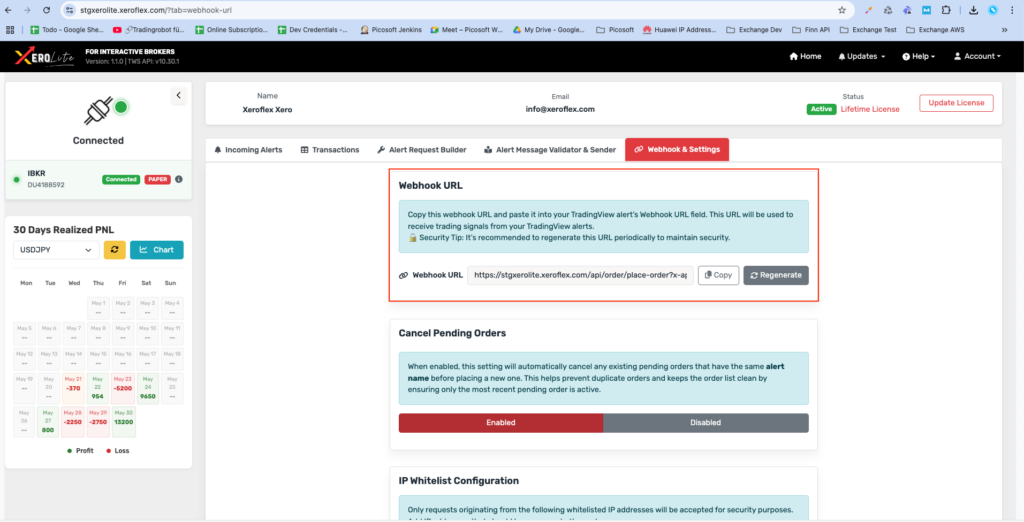

https://stgxerolite.xeroflex.com/api/order/place-order?x-api-key=YOUR_API_KEY

👉 This webhook URL is from the XeroLite demo platform. You can use it to test your TradingView alerts in real-time. It allows you to simulate order placements safely without connecting to a live brokerage account.

💡 To test: Paste the demo webhook URL into your alert. Then log in to XeroLite Demo and check the Alert Log and Transaction tab.

🚨 Important: Use a unique name in your alert (e.g. "name": "TestUser123-GBPJPY") to avoid mix-ups.

💡 Always log in to XeroLite Demo to get the latest webhook URL.

🧾 Step 4: Customize the Alert Message

🔹 Simple Alert (Market or Limit Order)

{

"name": "USDJPY Alert",

"action": "{{strategy.order.action}}",

"qty": "10000",

"symbol": "USD",

"currency": "{{syminfo.currency}}",

"asset_class": "FOREX",

"exch": "IDEALPRO",

"order_type": "MKT"

}🎯 Bracket Order (With TP/SL)

{

"name": "GBPJPY-LMT-TPSL",

"action": "{{strategy.order.action}}",

"qty": "10000",

"symbol": "GBP",

"currency": "{{syminfo.currency}}",

"asset_class": "FOREX",

"exch": "IDEALPRO",

"order_type": "LIMIT",

"tif": "DAY",

"price": "{{strategy.order.price}}",

"sl_offset": 0.0005,

"tp_offset": 0.0005

}🚀 Step 5: Automate Execution with XeroLite

XeroLite is a lightweight tool that bridges TradingView and Interactive Brokers. When your webhook fires, XeroLite will:

- Receive the webhook

- Authenticate and validate the alert

- Send the order to IBKR via TWS/IB Gateway

- Log the action for monitoring

✅ No coding. ✅ No browser plugin. ✅ Just pure automation.

Want to test first? Try the XeroLite Demo today — risk-free!

💡 Why Beginners Love Automated Trading

- ✅ Emotion-free trades

- ✅ Works 24/7

- ✅ Hands-off execution

- ✅ Learn gradually

📦 Recap – You’re Now Automated!

- ✅ Build a TradingView strategy

- ✅ Set webhook alerts

- ✅ Execute trades via XeroLite

Start small. Stay consistent. Let XeroLite handle the rest.